Margin trading is a way of trading with borrowed money. If you open a margin account at Olymp Trade India, you will gain access to funds other than your starting capital. This allows you to leverage your trading positions and rake in larger profits if your trade turns out to be successful. Immensely popular because it grants access to funds and amplifies profits, margin trading is done across a variety of instruments such as cryptocurrencies, commodities, and stocks.

So who provides these extra funds? Usually, you can borrow money from your online broker. In case of cryptocurrency trading, the funds are supplied by other traders. In rare cases, traders can obtain margin funds from cryptocurrency exchanges.

How It Works

When you enter a margin trading position, you have to make a down payment, which is usually a percentage of the total value of the trade. This down payment is called “margin” and is similar to “leverage.”

For example, if the total trade value is $100,000 and the broker offers a leverage of 10:1, you have to make a down payment of $10,000 to open the trade. Financial services have their own policies, terms & conditions, and rules related to leverage and margin.

Pros & Cons

If your trade turns out to be a success, you can enjoy the benefits of amplified profits. If you lose, however, you will lose a lot of money. Avoid margin trading if you don’t have the strength to absorb the shock.

Margin trading is useful for traders who prefer opening several positions with a small starting capital. Margin accounts are also convenient for traders who want to quickly open a trade position without having to transfer huge sums of money from their bank account to their trading account.

Before you even consider margin trading, you must understand that it is the riskiest way of trading. You are in danger of losing more than the amount you initially invested. Even the slightest price fluctuation can make a huge difference to your trade. You have to learn to implement effective risk management techniques such as stop loss orders if you want to become a successful margin trader.

Learn More about Margin Trading

You can learn more about margin trading in particular and trading in general at online trading platforms such as Olymp Trade. The best trading platforms in the industry not only offer their clients sophisticated online trading platforms, but also train and educate them free of cost.

The educational material at online brokers includes webinars, video tutorials, articles, eCourses, and eBooks, just to mention a few. The best thing about education at online brokers is that it is absolutely free of charge.

Why Olymp Trade?

What makes Olymp Trade a great place to learn about margin trading? We have picked the following reasons:

- Getting started at Olymp Trade is a quick and hassles free procedure. The sign up form is right on the homepage. You have to enter your email, create a password, choose from USD or EUR, check the box to affirm that you are of the legal age to trade and that you accept the service agreement, and click on the green Register button.

- Get started with a small deposit of $10. If you are unsure about trading, the company will not force you to make a huge deposit.

- Get started on a practice or demo account to get a taste of live trading without risking your own money. You can spend a few months mastering the basics of trading or testing a new trading strategy on a demo account.

- Learn the secrets of successful traders as Olymp Trade gives you the opportunity to meet and interact some of the top traders in the industry.

- When you start trading for real and making profits, you can withdraw them in just one working day.

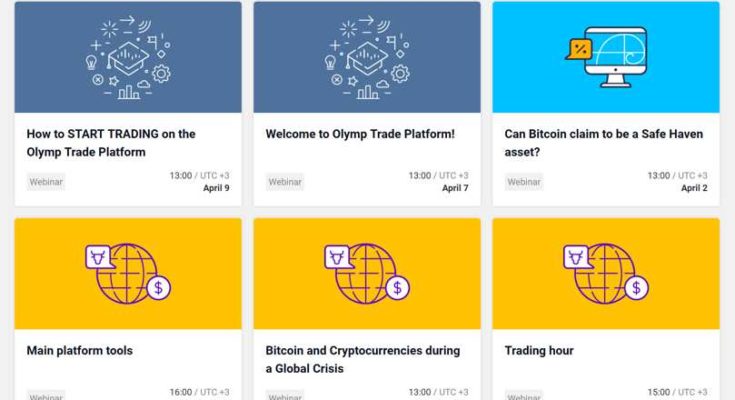

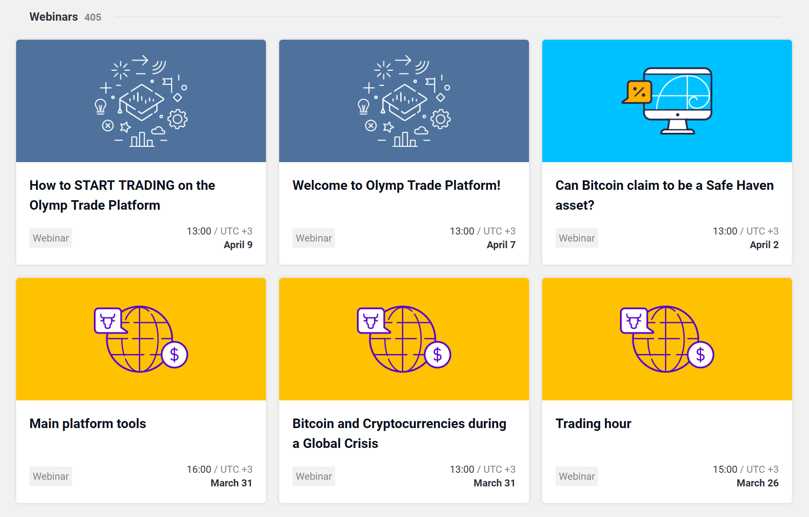

Learning Margin Trading through Olymp Trade Webinars

Olymp Trade is famous for its webinars. If you visit its education section, you will come across 420 resources, including five strategies, 398 webinars DO, and 17 webinars Forex.

On it’s about page, Olymp Trade clearly states that it not only gives traders an opportunity to make profits, but also shows them how. The online broker achieves this through a team of qualified analysts who are adept at creating original trading strategies. These analysts teach traders how to intelligently use these strategies in open webinars. Traders can also consult these analysts on a one-to-one basis.

The best thing about education at Olymp Trade is that it is available in all the languages that its clients understand.

There are two other ways to learn at Olymp Trade—Blog and Demo Account.

Blog: The Olymp Trade blog is great source of online trading information and training for beginners, intermediates, and advanced traders. The online broker updates its blog regularly; so you will find some new tip, trick, strategy, or news even if you visit it every day.

The blog has three major sections:

- Analytics: This section deals with analytics, trends, and news.

- Platform News: Check this section to find out what is new at Olymp Trade and how to make the most of it.

- Education: Browse articles from experts about important subjects such as trading psychology, technical analysis, and money management.

The blog also includes a FAQ, where you can find answers to commonly asked questions and a lifestyle section with special trading articles.

Demo Account: The best way to learn trading at Olymp Trade is through a practice or demo account. When you open a demo account at Olymp Trade, you receive 10,000 units of your selected currency in virtual money. You can use this virtual money to practice trading as long as you wish.

However, we do not recommend staying on the demo account for more than three months as the real fun is in live trading. You need not be afraid of plunging into live trading as Olymp Trade webinars teach you how to create informed and profitable trade positions.

Education never ends at Olymp Trade. Through its regularly updated educational resources, the online broker has proved that you always have something to learn even if you feel that you have become an expert trader.